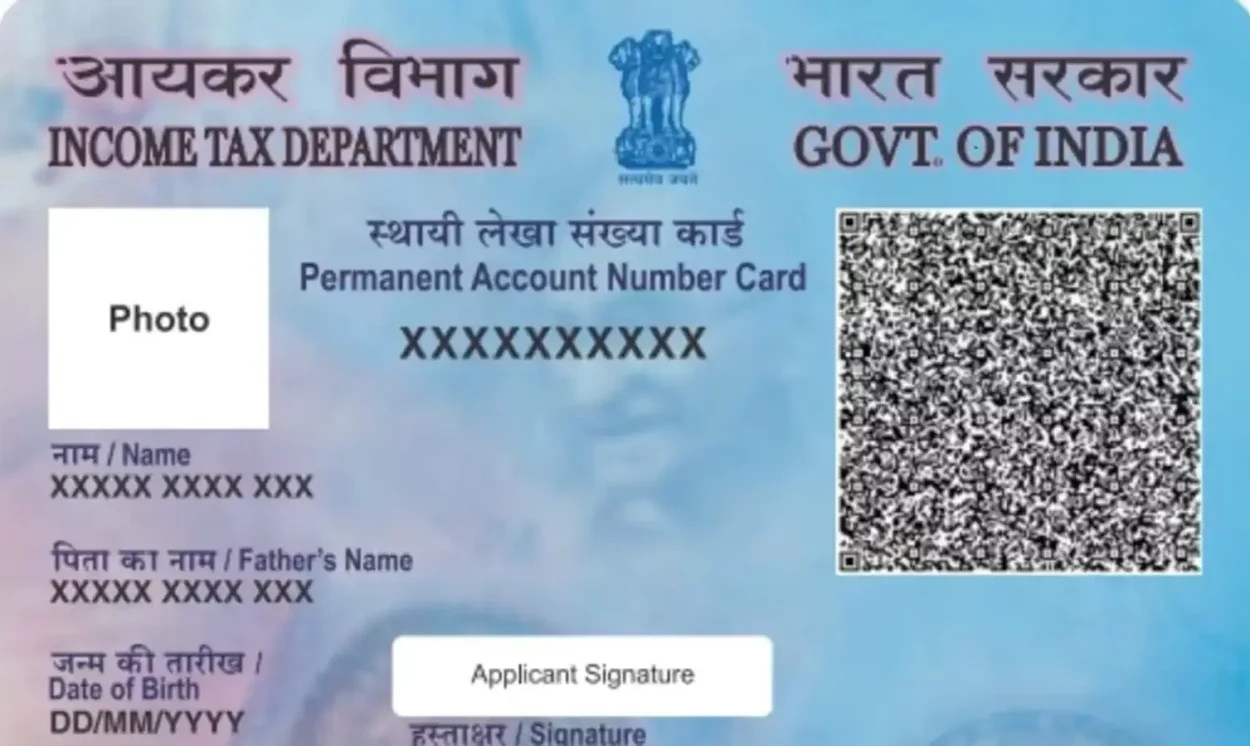

The PAN card is an official document issued by the Income Tax Department. PAN, an alphanumeric number, serves as a unique identifier for every individual holder, making it essential for financial transactions. Traditionally, obtaining a physical PAN card involved postage, printing, and manual handling, leading to potential delays. To simplify this process, the E-PAN was introduced.

E-PAN is the electronic version of the PAN card. For those already having a valid Aadhaar number, availing of the E-PAN service becomes seamless. This digital PAN card is provided in PDF format and is authenticated based on Aadhaar’s e-KYC data. One of the major benefits of E-PAN is its speed and eco-friendly, paperless procedure. To obtain it, all one needs is a mobile number linked with their Aadhaar. E-PAN holds legal validity, making it acceptable for all official tasks, including income tax filing. It’s a handy tool for all financial transactions.

To apply for an E-PAN, one must visit the Income Tax Department’s e-filing portal at https://www.incometax.gov.in/iec/foportal/. On the homepage, click on the ‘Instant E-PAN’ option. Follow the instructions, starting with entering your Aadhaar number. If your Aadhaar is already linked to a valid PAN, you will receive a notification. If not, ensure your Aadhaar is linked to a mobile number to receive an OTP for verification. After verification, click on ‘Continue’, select the checkbox, and submit. You will receive a message with a link, allowing you to download your E-PAN.

Embracing the digital transformation, E-PAN offers a swift and efficient way to manage your financial identity.

Image Credit – Mint